"Executive Summary Europe Tax IT Software Market :

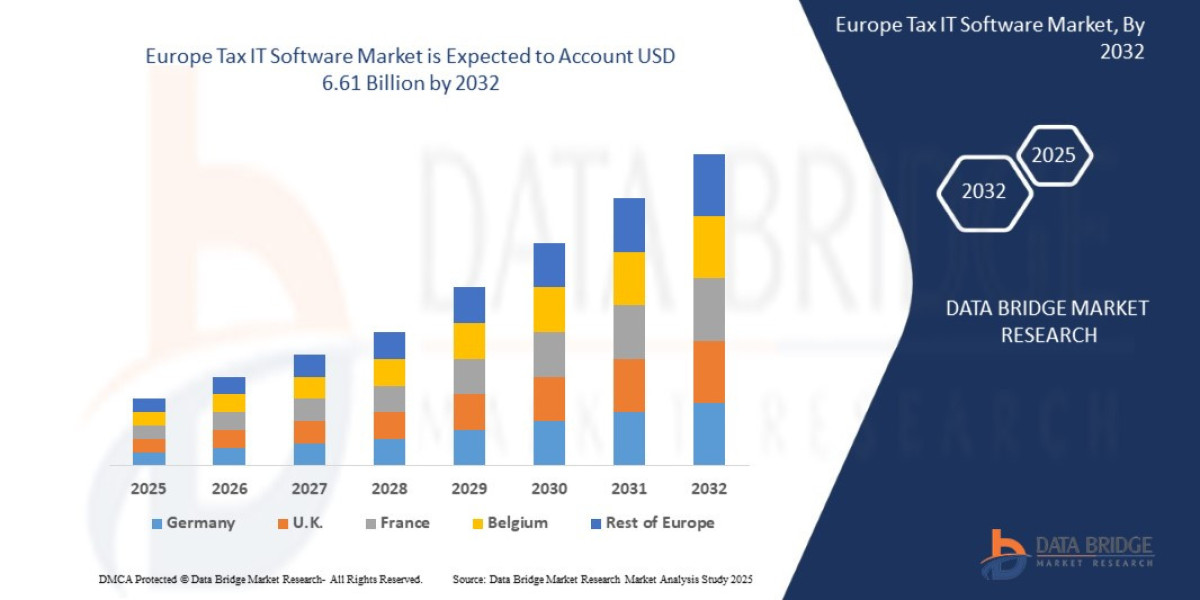

Data Bridge Market Research analyses that the tax the Europe tax IT software market is expected to reach USD 6.61 billion by 2032 from USD 3.88 billion in 2024 growing with a CAGR of 7.0% in the forecast period of 2025 to 2032

A credible Europe Tax IT Software Market report provides with the relevant information about the niche and saves lot of time that may otherwise get wasted for decision making. A premium market research report acts as an innovative solution for the businesses in today’s changing market place. The report offers a thorough synopsis on the study, analysis and estimation of the market and how it is impacting the industry. This industry analysis report is built by keeping in mind businesses of all sizes. The world class Europe Tax IT Software Market report is generated by thoroughly understanding business environment which best suits the requirements of the client.

The top notch Europe Tax IT Software Market research report offers an array of insights about industry and business solutions that will support to stay ahead of the competition. A systematic investment analysis is also underlined in this widespread report which forecasts impending opportunities for the market players. The persuasive Europe Tax IT Software Market report is an outcome of persistent and numerous efforts lead by knowledgeable forecasters, innovative analysts and brilliant researchers who carry out detailed and diligent research on different markets, trends and emerging opportunities in the consecutive direction for the business needs.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Europe Tax IT Software Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/europe-tax-it-software-market

Europe Tax IT Software Market Overview

**Segments**

- Based on Component: Tax Management Software, Income Tax Software, Sales Tax Software, Property Tax Software, Others.

- Based on Deployment Mode: On-Premises, Cloud.

- Based on Organization Size: Small and Medium-Sized Enterprises (SMEs), Large Enterprises.

- Based on End-User: Enterprises, Individuals.

The Europe Tax IT Software market is segmented based on various factors that play a critical role in shaping the industry landscape. The component segment includes tax management software, income tax software, sales tax software, property tax software, and others. This segmentation allows for a more targeted analysis of the software offerings in the market, catering to the specific needs of businesses and individuals.

In terms of deployment mode, the market is divided into on-premises and cloud-based solutions. This segmentation highlights the shifting trend towards cloud adoption in the tax software market, offering scalability, flexibility, and cost-efficiency to users. Moreover, the market segmentation based on organization size includes small and medium-sized enterprises (SMEs) and large enterprises, reflecting the varying software requirements of businesses based on their size and scale of operations.

Furthermore, the end-user segment categorizes the market into enterprises and individuals, showcasing the diverse target audience for tax IT software solutions. This segmentation enables software developers and providers to tailor their products to specific end-user needs, enhancing overall market competitiveness and customer satisfaction.

**Market Players**

- Thomson Reuters

- Wolters Kluwer

- Intuit Inc.

- TaxSlayer LLC

- Xero Limited

- Sage Group

- Vertex, Inc.

- Avalara

- H&R Block

- Sovos Compliance

The Europe Tax IT Software market is highly competitive, with key players such as Thomson Reuters, Wolters Kluwer, Intuit Inc., TaxSlayer LLC, and Xero Limited dominating the industry. These market players are constantly innovating and expanding their product portfolios to stay ahead in the competitive landscape. Additionally, companies like Sage Group, Vertex Inc., Avalara, H&R Block, and Sovos Compliance are also significant contributors to the market, offering a wide range of tax IT software solutions to meet the evolving needs of businesses and individuals in the region.

The Europe Tax IT Software market is witnessing significant growth and evolution driven by a range of factors. One key trend shaping the market is the increasing adoption of cloud-based solutions, which offer enhanced scalability, flexibility, and cost-efficiency for businesses of all sizes. As more organizations move towards cloud deployment models, there is a growing opportunity for software providers to offer innovative solutions tailored to these requirements. This shift is not only changing the way tax software is delivered but also impacting how businesses manage their tax processes more efficiently.

Moreover, the segmentation of the market based on components allows for a deeper understanding of the diverse software offerings available to businesses and individuals. Tax management software, income tax software, sales tax software, property tax software, and other specialized solutions cater to specific tax-related needs, providing a comprehensive ecosystem for users to choose from based on their requirements. This level of segmentation ensures that the market is well-defined and allows for targeted product development and marketing strategies.

Additionally, the differentiation based on organization size, whether small and medium-sized enterprises or large enterprises, highlights the varying software needs of businesses based on their scale of operations. SMEs may require more cost-effective and streamlined solutions, while large enterprises may seek more comprehensive and scalable software to manage complex tax processes. This segmentation enables software providers to customize their offerings to meet the distinct needs of different types of organizations, enhancing overall market competitiveness.

Furthermore, the end-user segmentation into enterprises and individuals reflects the diverse target audience for tax IT software solutions in the European market. Enterprises may have more complex tax management requirements, such as compliance with multiple tax jurisdictions or international tax regulations, while individuals may seek simpler solutions for personal tax filing. This segmentation helps software developers tailor their products to specific end-user needs, ensuring that their solutions are relevant and impactful in addressing the diverse requirements of the market.

In conclusion, the Europe Tax IT Software market is dynamic and competitive, driven by key players who are continuously innovating and expanding their offerings to stay ahead in the market. With evolving trends such as cloud adoption, targeted market segmentation, and a diverse customer base, the market is poised for further growth and development as businesses and individuals seek more sophisticated and efficient tax management solutions.The Europe Tax IT Software market is currently experiencing significant growth and transformation, driven by various key factors. Apart from the increasing adoption of cloud-based solutions, several other trends are shaping the market dynamics. One crucial trend is the focus on enhancing automation and efficiency in tax processes. As businesses strive for increased accuracy and compliance in tax management, there is a rising demand for software solutions that can streamline workflows and reduce manual intervention. This push towards automation is likely to fuel the development of more sophisticated tax IT software offerings that leverage technologies such as artificial intelligence and machine learning to optimize tax operations.

Another noteworthy trend in the market is the emphasis on regulatory compliance and adherence to evolving tax laws. With tax regulations becoming increasingly complex and subject to frequent changes, organizations are seeking software solutions that can ensure compliance and provide real-time updates on tax requirements. This requirement for regulatory alignment is creating opportunities for software providers to develop robust systems that can adapt to changing tax landscapes and help businesses avoid penalties or non-compliance issues.

Moreover, the market landscape is witnessing a shift towards personalized and user-centric software solutions. As businesses and individuals look for tailored tax management tools that cater to their specific needs, software developers are focusing on creating customizable and user-friendly interfaces. By incorporating features such as interactive dashboards, personalized tax filing options, and predictive analytics, tax IT software vendors can offer a more engaging and intuitive experience to their customers, enhancing overall user satisfaction and retention.

Additionally, the market is also seeing a growing trend towards integrated tax management platforms that consolidate various tax functions into a single cohesive system. This integration of tax management software with accounting, auditing, and financial reporting tools enables businesses to have a comprehensive view of their financial activities and tax obligations in one centralized platform. By providing a seamless and interconnected ecosystem, integrated tax IT solutions can improve operational efficiency, data accuracy, and decision-making processes for organizations, leading to increased adoption rates and market competitiveness.

Overall, the Europe Tax IT Software market is evolving rapidly, driven by trends such as automation, regulatory compliance, personalization, and integration. With a focus on innovation and meeting the diverse needs of businesses and individuals, the market is poised for further growth and development in the coming years. As technology continues to advance and tax requirements become more intricate, the demand for advanced and tailored tax IT solutions is expected to rise, creating opportunities for market players to differentiate their offerings and stay ahead in the competitive landscape.

The Europe Tax IT Software Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/europe-tax-it-software-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Coverage in the Europe Tax IT Software Market Report:

- Detailed analysis of Global Europe Tax IT Software Marketby a thorough assessment of the technology, product type, application, and other key segments of the report

- Qualitative and quantitative analysis of the market along with CAGR calculation for the forecast period

- Investigative study of the market dynamics including drivers, opportunities, restraints, and limitations that can influence the market growth

- Comprehensive analysis of the regions of the Europe Tax IT Software Marketand their futuristic growth outlook

- Competitive landscape benchmarking with key coverage of company profiles, product portfolio, and business expansion strategies

Browse More Reports:

Global Hospice Market

Global Transfusion Bottle Market

Global Enzyme-Linked Immunosorbent Assay (ELISA) Tests Market

Global Train Ceiling Modules Market

Global Cloud Radio Access Network Market

Global Processor IP Market

Asia-Pacific Smoke Detector Market

Europe Long Chain Polyamide Market

Global Vehicle Emission Testers Market

Global Fish Protein Hydrolysate Market

Global Toothpaste Flavors Market

Global Flat Panel Displays Market

North America Automotive Sensor and Camera Technologies Market

Asia-Pacific Colour Concentrates Market

Global Scrambled Egg Mix Market

Global Ethylene Acrylic Acid (EAA) Market

Global Calcineurin Inhibitors Market

Global Dimethylformamide Market

Asia-Pacific Superalloys Market

Global Miticides Market

Global Swimming Pool Alarm Market

Global Eco-Friendly Labels Market

Global Smart Aquaculture Market

Global Ophthalmic Ultrasound Devices Market

Global Botanical Skin Care Ingredients Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]