The OCTG market (Oil Country Tubular Goods) is witnessing a significant resurgence as oil and gas exploration activities rebound globally. OCTG includes a range of steel tubular products—casing, tubing, and drill pipes—used extensively in drilling and production operations. The market is experiencing increased demand due to expanding upstream projects, shale exploration, and the shift toward unconventional energy sources.

With the resurgence of drilling activities in North America, the Middle East, and parts of Asia-Pacific, the OCTG market is gaining strong momentum. Innovations in steel grades, corrosion resistance, and seamless manufacturing technologies are further enhancing the performance and durability of these critical components in the oil and gas value chain.

Market Dynamics

One of the primary drivers of the OCTG market is the revival of oil and gas exploration activities in both conventional and unconventional reservoirs. As global energy demand rebounds post-pandemic and prices stabilize, exploration and production (E&P) companies are ramping up drilling operations, especially in shale-rich regions such as the U.S. Permian Basin and Argentina's Vaca Muerta.

Technological advancements in horizontal and directional drilling have increased the need for robust, high-strength OCTG products. Longer wellbores and deeper reservoirs require casing and tubing that can withstand high pressure, temperature, and corrosive environments. This has driven the adoption of premium connections and high-alloy grades to ensure reliability and performance.

Geopolitical developments and energy security concerns are influencing regional exploration strategies, further propelling OCTG demand. Countries are seeking to boost domestic energy production to reduce import dependence, particularly in light of global supply disruptions and evolving geopolitical tensions.

The market is also supported by increased investments in offshore oil and gas projects. Deepwater and ultra-deepwater exploration, particularly in the Gulf of Mexico, West Africa, and Southeast Asia, are contributing to OCTG consumption. These applications require seamless tubular goods with enhanced fatigue resistance and load-bearing capacity.

Environmental regulations and sustainability concerns have led to the development of eco-friendly and recyclable OCTG materials. Manufacturers are optimizing production methods to reduce carbon footprints and adopt energy-efficient processes, aligning with the broader goals of decarbonizing the energy sector.

Competitive Landscape

The OCTG market is marked by strong competition among global steel producers, specialized OCTG manufacturers, and regional suppliers. Major players include Tenaris S.A., Vallourec S.A., Nippon Steel Corporation, TMK Group, JFE Steel Corporation, ArcelorMittal, and United States Steel Corporation.

Tenaris S.A., one of the industry’s dominant players, offers a comprehensive portfolio of OCTG products and services, including threading, heat treatment, and corrosion-resistant alloys. The company focuses on digital integration and seamless supply chain management to deliver tailor-made solutions to E&P clients worldwide.

Vallourec S.A. is a key supplier of seamless tubular solutions for both onshore and offshore drilling operations. The company emphasizes R&D and partnerships with oilfield service providers to innovate high-performance materials suitable for complex well environments.

Nippon Steel Corporation brings extensive expertise in steel production, supplying a wide range of OCTG solutions that cater to high-pressure, high-temperature (HPHT) wells. Its premium connection technologies are widely adopted in challenging drilling conditions.

TMK Group, a leading Russian manufacturer, provides a broad spectrum of welded and seamless OCTG products. The company leverages vertical integration from steelmaking to finishing operations, allowing greater control over quality and cost efficiency.

JFE Steel Corporation is known for its corrosion-resistant OCTG products and precision manufacturing capabilities. The company has a strong presence in Asia-Pacific and supplies to key offshore markets with demanding specifications.

United States Steel Corporation (U.S. Steel) continues to support domestic shale exploration through its American-made OCTG products, promoting energy independence and local content mandates. Its recent investments in modernized mill infrastructure have increased output and product range.

The market is increasingly shaped by strategic collaborations, joint ventures, and digital service integration. Players are offering lifecycle support, real-time inventory management, and remote monitoring systems to create value-added service models that go beyond traditional product supply.

Future Outlook and Strategic Opportunities

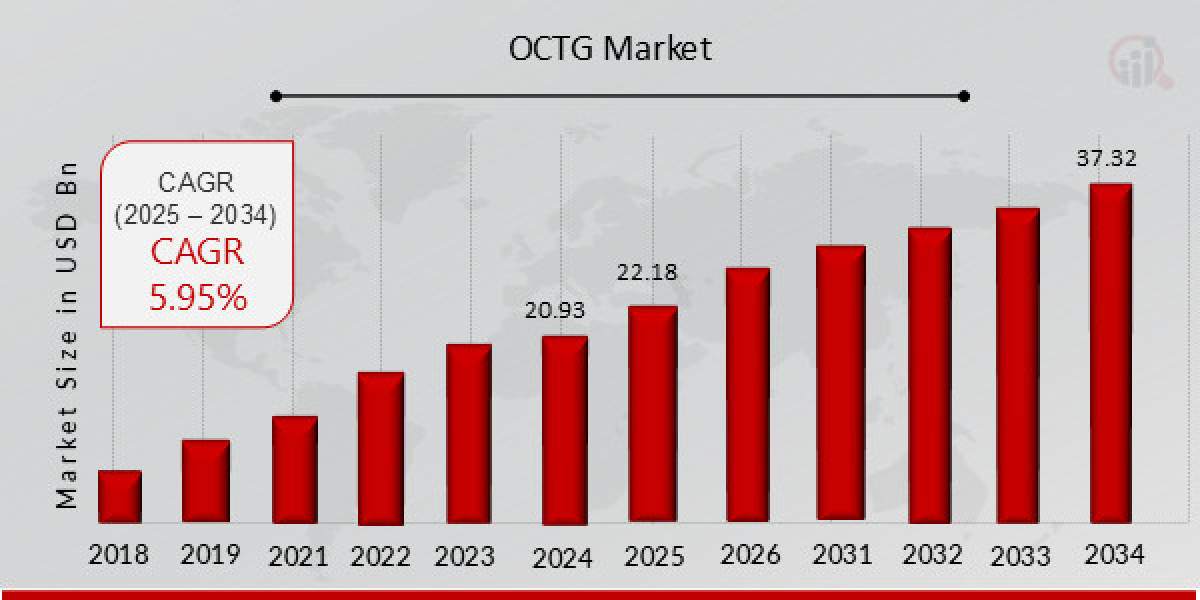

The OCTG market is set for continued growth, backed by strong fundamentals in the upstream oil and gas sector. As global exploration shifts toward deeper, more complex reservoirs, demand for high-performance tubular goods will rise steadily.

Opportunities are particularly strong in North America, where shale development continues to dominate drilling activity. The U.S. remains a major consumer of OCTG, especially for unconventional plays requiring advanced horizontal drilling and frequent well completions.

Middle Eastern markets, led by Saudi Arabia, UAE, and Qatar, are ramping up production to meet both domestic energy needs and export commitments. National oil companies (NOCs) are investing in long-term expansion projects, which will continue to drive OCTG requirements in the region.

Digitalization and smart manufacturing will play a pivotal role in shaping the future of the OCTG industry. From predictive maintenance of drill strings to automated inspection and traceability, integrating digital tools will enhance product quality, reduce operational risks, and improve cost-effectiveness.

Sustainability is also becoming central to procurement decisions. Companies that offer recyclable, low-carbon OCTG solutions are likely to gain a competitive advantage in an industry that is slowly but surely transitioning toward greener operations.

Challenges such as raw material volatility, trade tariffs, and supply chain disruptions will remain relevant. However, companies with diversified manufacturing bases, strategic inventory management, and innovation-driven approaches will be best positioned to navigate market uncertainties.

In conclusion, the OCTG market is evolving in response to changing energy demands, technological advancements, and sustainability pressures. With drilling activities on the rise and exploration moving into more demanding terrains, the market will continue to offer strategic opportunities for innovation, efficiency, and growth.

More Trending Reports:

Three Phase Pad Mounted Transformer

Low Voltage Circuit Breakers Sales