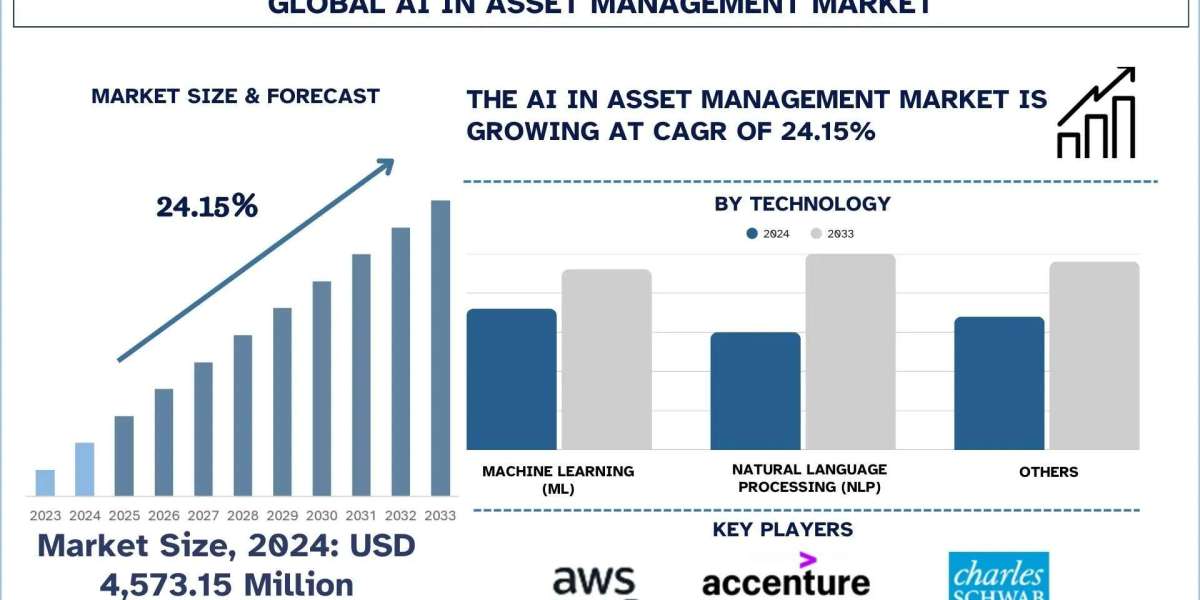

According to a new report by UnivDatos, the AI in Asset Management market is expected to reach USD million in 2033 by growing at a CAGR of 24.15%. The market of Artificial Intelligence in Asset Management is expanding because of the evolution of the financial markets and the necessity to make quicker and more exact decisions in investments. Asset managers are embracing AI to effectively process large amounts of financial and other data to enhance the efficiency of portfolio management and risk management. Adoption is also increasing at a rapid pace as the company is pressured to automate to minimize operational expenses, improve compliance, and minimize human error. Also, the increased pace of interest in customized investment products, robo-advisory software, and real-time analytics is spurring the adoption of AI.

Growing demand for data-driven investment decision-making

The increasing need for data-driven investment decision-making is an important market contributor to Artificial Intelligence in Asset Management since financial markets are producing large amounts of both structured and unstructured data that cannot be effectively analyzed in a traditional way. The use of AI-driven analytics to process market data, financial statements, macroeconomic indicators, and other types of alternative data is increasingly relied upon by asset managers to process real-time market information, including news, social media, and transaction-related data. This allows more precise forecasting, rapid identification of investment opportunities, and the optimization of risk-return. With the growing competition and the increasing customer demands regarding higher quality of performance and transparency, asset management companies are implementing AI-driven insights to advance portfolio strategies, achieve agility, and gain a competitive advantage in the ever-changing market environments.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/artificial-intelligence-in-asset-management-market?popup=report-enquiry

According to the report, the Asia-Pacific region is expected to grow fastest in the AI in Asset Management Market

The global artificial intelligence (AI) market in Asset Management will grow most rapidly in the Asia-Pacific region, driven by the rapid digitalization of financial services and the increasing use of sophisticated analytics by asset managers. China, India, Japan, and South Korea are among the countries that have been experiencing increased investment in fintech, AI infrastructure, and cloud technologies. Adoption is further being accelerated by expanding capital markets, an increasing number of retail and institutional investors, and the need to use data in making investment strategies. Also, government programs, growing access to big data, and the availability of upcoming AI startups are contributing to the accelerated adoption of AI-based asset management solutions in the region.

Related Reports:-

Artificial Intelligence Market: Current Analysis and Forecast (2025-2033)

Artificial Intelligence Prompt Marketplace Market: Current Analysis and Forecast (2025-2033)

Asset and Wealth Management Market: Current Analysis and Forecast (2022-2028)

Adaptive AI Market: Current Analysis and Forecast (2024-2032)

AI in Manufacturing Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/