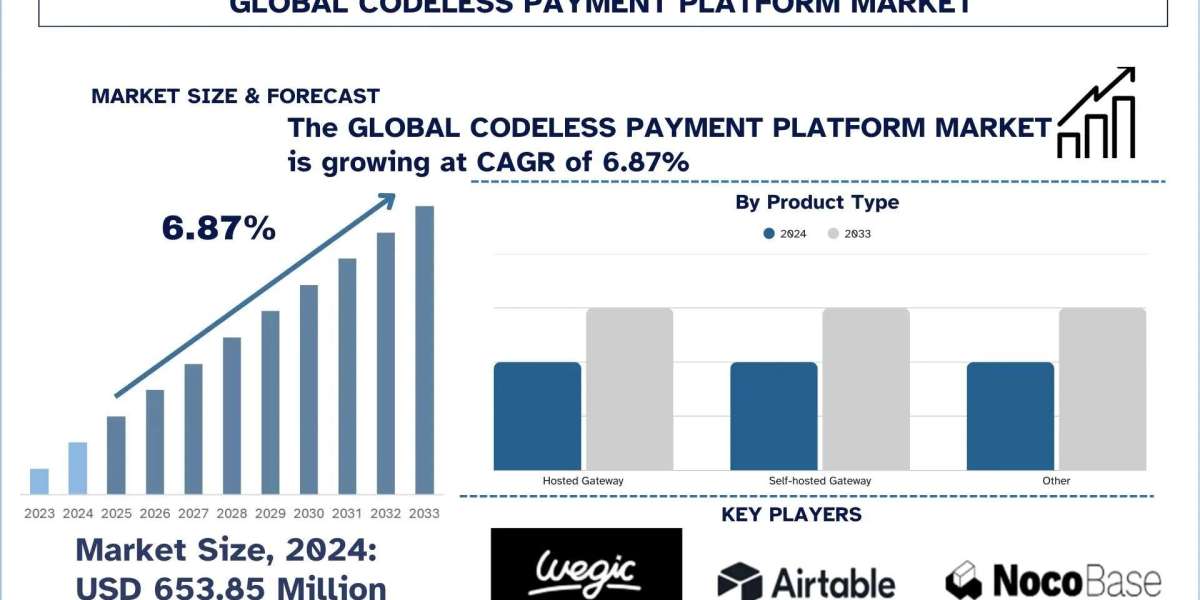

According to a new report by UnivDatos, the Codeless Payment Platform Market is expected to reach USD million by 2033, growing at a CAGR of 6.87% during the forecast period (2025-2033F). Codeless payment systems are increasingly challenging, yet the current reality requires orchestrating transactions with the highest degree of reliability and without disrupting checkout performance across a broad range of channels, territories, currencies, and risk scenarios. Security and compliance demands, stricter economic constraints, and a push toward embedded finance, real-time payments, and unified commerce increasingly drive the market for codeless payment platforms. As a central enabling layer of today's payment stack, these platforms are a major focus for merchants, PSPs, and SaaS vendors, affecting conversion, fraud risk, settlement speed, and overall operating expenses across the industry. It can also be justified by the fact that custom-written integrations were replaced by configurable workflows and API abstraction that leverage tokenization, network rules, and smart routing, enabling scalability, auditability, and shorter time-to-market. The strategic use of the latest risk indicators, identity checks, orchestration rules, and analytics, along with accurate configuration management to manage chargebacks, adapt to changing regulations, and maintain performance continuity during long growth periods, is key to market expansion. Simultaneously, over the last few years, the capability of payment operations to operate effectively with automated reconciliation, AI-assisted fraud control, and an intelligent monitoring system has been emphasized as the omnichannel demands, subscriptions, and growing cross-border and instant-payment applications increasingly require traditional payment architectures to become more resilient, configurable, and evolving.

Segments that transform the industry

· The Hosted Gateway segment is projected to hold the largest market share and remain dominant throughout the forecast period. This is because the hosted models fit the most popular mid-market and enterprise use cases in digital commerce that require fast deployments, reduced reliance on engineering, and built-in compliance (e.g., PCI scope reduction), and provide predictable checkout experiences across devices and geographies. Such platforms generally offer pre-certified payment systems, automated updates, tokenization, and risk configurations, allowing merchants, marketplaces, and SaaS providers to manage conversion, security, and operating costs under stricter regulatory and fraud pressures. Self-hosted Gateway, in turn, is expected to grow the fastest as the need for stronger control over the user experience, data disposal, and routing decisions among large retailers, super-apps, and regulated industries increases.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/codeless-payment-platform-market?popup=report-enquiry

According to the report, the impact of the Codeless Payment Platform has been identified as high for the North America region. Some of how this impact has been felt include:

North America dominated the global codeless payment platform market and will likely maintain that position over the forecast period. The existence of a well-developed digital commerce ecosystem, card and wallet saturation, extensive cloud adoption, and the presence of the largest payment processors, fintechs, and SaaS platforms enable the rapid introduction of new payment methods without intensive engineering support. Large companies in the retail sector, the travel sector, subscription service, and marketplaces are also actively investing in payment orchestration, tokenization, and fraud controls, and this creates long-term demand for configurable gateway layers, smart routing, and the provision of a single reporting to enhance the authorization rate and reduce processing costs. As more buyers move toward omnichannel purchasing, compliance and security requirements increase; consequently, more merchants are adopting codeless solutions to unify the checkout process, accelerate cross-border growth, and reduce operational strain in reconciliation and chargeback management. Additionally, the market is growing rapidly as the transition to embedded finance and platform-based payments continues, with payment functionality bundled into software products and deployed at scale.

Related Reports:-

Payment as a Service Market: Current Analysis and Forecast (2022-2028)

Digital Commerce Platform Market : Current Analysis and Forecast (2024-2032)

Credit Card Fraud Detection Platform Market: Current Analysis and Forecast (2025-2033)

Value-Based Care Market: Current Analysis and Forecast (2021-2027)

Global Digital Payment Market: Current Analysis and Forecast (2020-2026)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/