For decades, commercial insurance revolved around predictability. Many buyers were long-established business owners who valued long-term broker relationships, annual renewals, and familiar paperwork-driven processes. Trust, habit, and price guided most decisions, and loyalty was often inherited rather than earned.

That model is rapidly changing. A growing share of U.S. business owners are under 40, running companies that look nothing like the asset-heavy firms of previous generations. These founders are building technology-enabled, service-driven, and digitally operated businesses that expect speed, transparency, and self-service in every vendor relationship — including insurance. As a result, business insurance customer loyalty is no longer secured by longevity alone. It must be designed, measured, and continuously reinforced.

A New Buyer With New Expectations

Younger entrepreneurs operate in real time. They manage payroll through cloud platforms, track cash flow instantly, and automate compliance. They are accustomed to dashboards, notifications, and frictionless digital experiences. When insurance still feels slow, opaque, and document-heavy, the gap becomes impossible to ignore.

Waiting days for a quote, emailing back and forth for certificates, or chasing underwriting updates feels outdated compared to the rest of their business stack. These experiences directly influence perception of value and trust. If an insurer cannot match the operational pace of the business owner, loyalty erodes quickly — even if pricing is competitive.

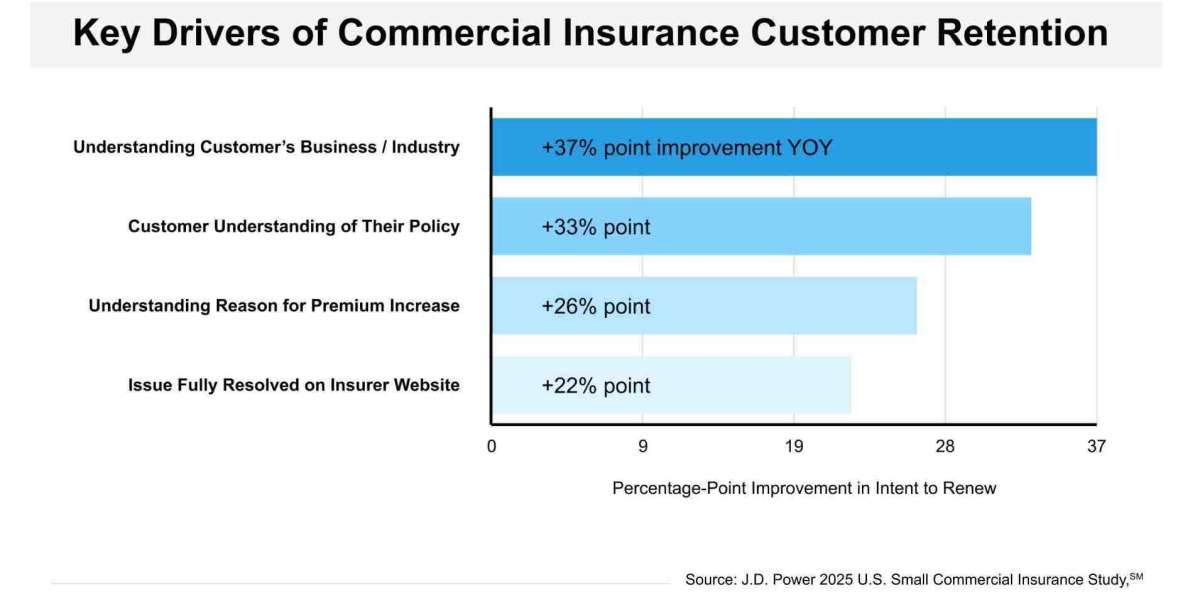

Loyalty Is Shifting From Relationship-Based to Experience-Based

Historically, loyalty was anchored in personal relationships with brokers and renewal familiarity. Today, loyalty increasingly depends on usability, responsiveness, and clarity. Business owners want:

Instant access to policies, documents, and certificates

Transparent pricing and coverage explanations

Real-time updates on underwriting and claims

Digital self-service without sacrificing human support

Proactive risk insights instead of reactive paperwork

In this environment, business insurance customer loyalty is built on consistent experience rather than legacy relationships. A smooth digital journey becomes as important as coverage quality.

The Rise of Embedded and Integrated Insurance

Another major shift shaping loyalty is integration. Younger businesses prefer tools that connect seamlessly with their accounting, HR, logistics, and operations platforms. Insurance products that integrate into existing workflows — such as automated certificate generation for contractors or usage-based coverage tied to operations — reduce friction and increase perceived value.

When insurance feels embedded rather than separate, it becomes harder to replace. This creates stronger retention and deeper engagement while improving operational efficiency for the customer.

Personalization Is the New Retention Strategy

Modern business owners expect personalized insights, not generic renewal reminders. Carriers that leverage data intelligently can offer tailored coverage recommendations, proactive risk alerts, and customized pricing models. This moves the insurer from a transactional vendor to a strategic partner.

For example, a logistics startup may benefit from dynamic liability adjustments during seasonal spikes, while a professional services firm may need evolving cyber coverage as remote operations expand. Anticipating these needs builds trust and long-term loyalty.

Speed Builds Confidence

Response time has become a core loyalty driver. Fast quotes, automated endorsements, and instant certificates reduce operational delays and improve confidence. When business owners know their insurer can move at the speed of their operations, switching becomes less attractive.

Speed also signals competence. A streamlined digital experience communicates that the insurer understands modern business realities and values the customer’s time.

Transparency Strengthens Trust

Younger buyers expect clarity around pricing, coverage limitations, claims processes, and policy changes. Hidden fees, complex language, or delayed explanations quickly damage credibility. Insurers that invest in plain-language policy summaries, real-time status tracking, and accessible support channels build stronger trust — a foundation for sustainable loyalty.

The Future of Business Insurance Customer Loyalty

As the American small business landscape continues to evolve, insurers must rethink how loyalty is earned and maintained. Technology alone is not enough. The winning formula blends digital efficiency with human expertise, personalization with scalability, and speed with transparency.

Business insurance customer loyalty in the modern era is no longer inherited — it is actively earned every interaction. Carriers that align their platforms, processes, and culture around the expectations of today’s entrepreneurs will not only retain customers but become indispensable partners in their growth journey.